True or False?

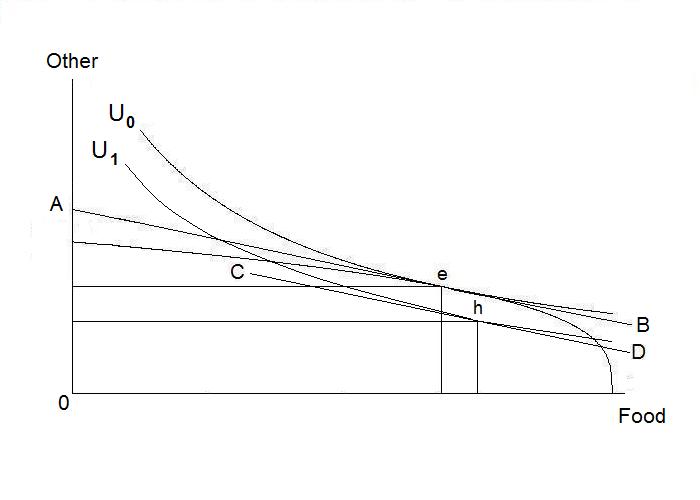

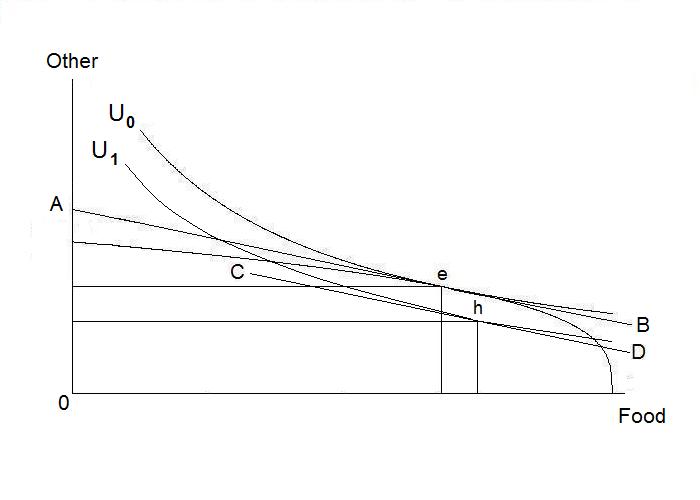

The statement is true. Consider the Figure below.

If the country is very poor, food might well be an inferior good in the sense that a fall in income will lead to an increase in the consumption of it. When poor people become poorer, they may value food consumption more than the consumption of luxury non-food items that rich people typically buy. This is illustrated by the decline in income denoted by a shift of the budget constraint downward from point e as represented by the line CD as compared to line AB. At the lower budget constraint, the mix of food and the other composite good consumed is given by point h. A tax on food production, however, will involve a movement along the production possibilty curve as long as the lump-sum redistribution of the tax revenue eliminates any income effect at the original output mix, ensuring that the community's real income and production possibilities are not reduced. Therefore, starting from point e, the increase in the price of food relative to its marginal cost must involve a movement to the left along the unchanged production possibility curve, putting the community on a slightly lower indifference curve. As long as food and other goods are substitutes at an unchanged utility level the imposition of the tax, holding measured real income constant, must reduce production and consumption of food.